Are Short-Form Videos the Future of Webtoons?

Probably not, but everyone else seems to think so.

Everyone’s always looking for the future of webtoons. The next step. The next phase.

It might be a consequence of being on the edge for so long that the industry isn’t satisfied with finding success in one industry, they’re looking to find success in the next, even if it doesn’t exist.

That’s where the whole NFT X webtoon crossover started. Back crypto and web3 were at the forefront of tech (or at the least, fintech), every webtoon company in Gangnam was looking at how to capitalize on NFTs with webtoon IPs.

One of the suggestions I heard was minting a crypto-Coin using the virtual currency of a webtoon platform. Like DogeCoin but you could purchase webtoon episodes with it.

It sounds stupid in hindsight, I know. But believe me… it sounded stupid at the time, too.

The Sum of (Unspoken) Fears

Let’s say the quiet part out loud

Everyone’s worried that webtoons are a fad that will pass with time.

With the exception of content producers and creatives whose livelihoods are sunk into the medium, many of the business operators in the industry think that we’re living in a bubble.

And they’re not wrong. Not entirely.

Currently, there are only two companies who (on paper) are profitable in the webtoon space: Lezhin and Toomics. Toomics, which is a myriad of shell companies and holdings talks about being in the black, but it’s a mystery I’ll leave to financial professionals to answer. Lezhin, on the other hand, is in the black thanks to their merch division which has pulled the company out of the red.

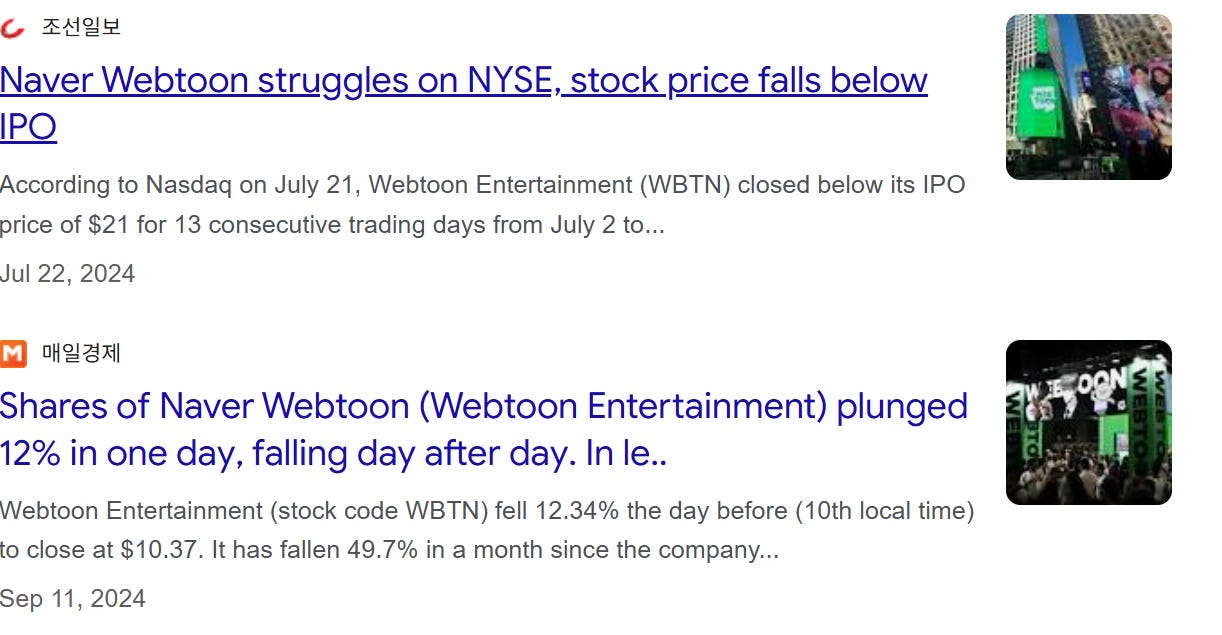

Naver, for all their resources, has very plainly stated they’re deep in the red. And their financials are actually very indicative of the industry as a whole. The expenses of being the world’s largest publisher are… expensive. But content acquisition, production and marketing for any platform are prohibitively expensive.

Enough so that many platforms get stuck in a cycle of spending until their inevitable closure.

So… what’s the answer?

If at First You Don’t Succeed…

Around the same time webtoon platforms started expanding overseas to the US, Europe, and Japan, companies with the production means started experimenting with a new form of video content, “webdramas”.

Webdramas were essentially K-dramas with episodes ranging from 10 minutes to 20 minutes. the idea was to create more “bite-sized” content geared at younger audiences.

It was a new push with multiple companies attempting to corner the market in its infancy. Naver made a not-insignificant push with their Naver TV platform focused on targeting younger, teen audiences.

It didn’t work.

Instead, surprisingly, the more traditional webnovel and webtoon mediums thrived with the addition of 4G and 5G internet speeds in Korea. And the concept of webdramas left everyone’s minds.

Until now, that is.

Short-Form Salvation

On paper, short-form videos are incredibly similar to webtoons.

Both are offered in pay-as-you-go and subscription models, and

both are meant to be consumed in short sprints with the potential for binging down the line.

In fact, many short-form platforms in Asia are modeled after webtoon platforms down to the Coin system and weekly episode releases.

Even the B2B aspect holds a lot of similarities with minimum guarantees, revenue sharing, not to mention exclusivity being key aspects of any licensing deal.

Most importantly, audience engagement with short-form video content has seen massive growth in recent years. TikTok and Youtube Shorts (as well as the many copycats) have exploded in popularity.

In the years since COVID, webtoon publishing has struggled. The post-pandemic environment has seen multiple international platforms shutter their services and while there have been successful adaptations of webtoon IPs, it’s still an expensive gamble.

In the meantime, the short-form video medium’s popularity continues to rise and present a cost effective-solution to the problem of expensive live action or animated adaptations.

The Gold Rush

Hints of Naver’s animated short-form video platform have been rumored for months. It wasn’t until earlier this year that we got the name, “Cuts”, and the logo.

Back in May, Sedaily reported that phase one was introducing it as a feature on on the Webtoon app before expanding it into a global (and presumably standalone) service. The first phase is up and running, but whether it’s providing a base for their eventual evolution to an independent platform is anyone’s guess.

For their part, Kakao isn’t taking this lying down. They’ve been very public about the development of their “Helix Shorts” AI service which can produce short 30-second videos in about 3 hours for about 60,000 KRW (ChosunBiz). It was implemented for use on the KakaoPage platform back in April to promote titles along with their AI-powered “Helix Curation” system.

And most recently, RIDI announced their own “Kanta” short-form video service in Japan (ChosunBiz). The content on the platform are essentially short-form K-dramas with new titles set to launch every month. While there isn’t any direct tie-in to their Ridibooks or Manta platforms in Korea and North America, it is tied into RIDI’s global strategy to expand into the video content market. And, if successful, I have to imagine that the library of webtoon and webnovel IPs at their disposal would come into play quite quickly.

Betting Long on Short-Form Videos

There is no shortage of companies attempting to get their piece of the short-form video streaming pie. Whether it be streaming platforms, production studios, or webtoon publishers looking to license their IPs, the market was nearly saturated the second it appeared.

And, now that heavy-hitters like Naver and Kakao have expressed interest in the market, it’s only a matter of time before other companies follow suit. So, RIDI’s choice to launch an overseas service seems prudent in an effort to pre-empt a less saturated market rather than duke it out in Korea or China.

But, that’s only if this works.

There hasn’t been a proven audience for short-form content outside of China. And, while China is a huge market, the short-form production and distribution market is completely saturated with local players.

Which only leaves secondary markets like Korea, Japan and the US. None of which are nearly as developed as China is.

The data on short-form video consumption outside of established platforms like Youtube, Instagram, and TikTok isn’t fully formed. We’ll have to wait to see if short-form paid videos are able to clear a decent return, or if the effort behind them fizzles out before that can happen.