Kakao's Q3 Press Release Has Its Ups (and Downs)

Digging through the numbers and looking for answers.

A Not-So-Quick Overview of Kakao

While there are multiple companies under the Kakao umbrella, Kakao splits their earnings results into two major categories: Platform and Content.

From there, the Platform side is split into Talk Biz (ads and commerce related to the KakaoTalk messenger), Portal Biz (which ad revenue from multiple sources including Daum), and Platform-Others which covers commerce aspects like KakaoPay as well as Enterprise, Healthcare and others.

The Content side is a bit easier to understand with Game (mobile and PC gaming), Music (which covers SM Entertainment, Melon, and other production/distribution services), Story (which is Piccoma and Kakao Entertainment) and finally Media which handles video production and talent management.

Charting Q3 Revenue

Kakao brought in a total revenue of 2.086 trillion KRW in Q3 representing a 2.9% increase QoQ (from 2.028 trillion KRW in Q2) and 8.6% YoY (from 1.921 trillion KRW in Q3 2024).

The Platform side brought in 1.059 trillion KRW (0.4% QoQ, 12.3% YoY). At least a few analysts are curious to see how the Talk Biz handles Q4 due to a disastrously unpopular update that was pushed through in October. This quarter, it accounted for 534 billion KRW representing a -1.4% drop QoQ and 6.6% increase YoY. It should be noted that KakaoTalk is the most popular app messenger in Korea, so growth is generally difficult from this stage forward.

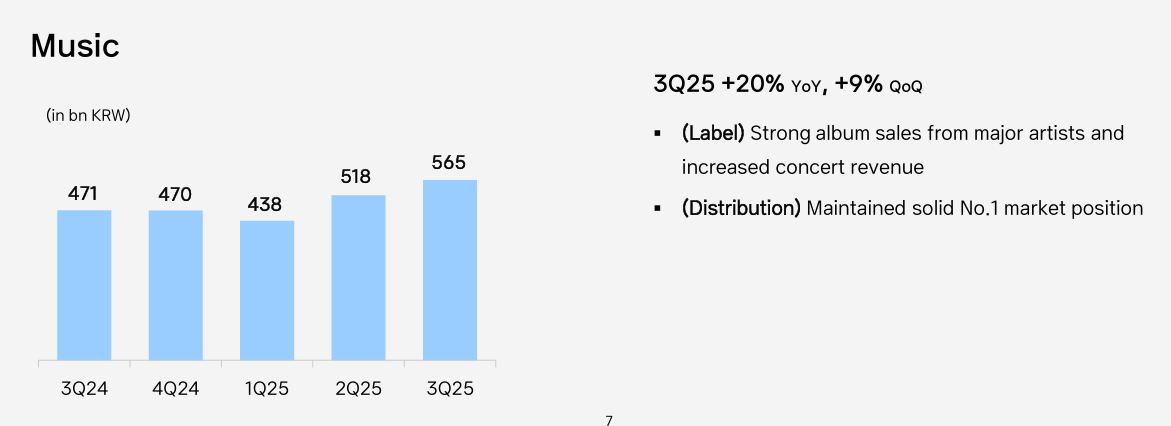

The Content side saw 1.026 trillion KRW (5.5% QoQ, 5.0% YoY). The biggest increase was seen in Music which accounted for 565 billion KRW (9.2% QoQ, 20% YoY). The Story side (which includes webtoons and webnovel businesses) saw 211 trillion KRW (-3.3% QoQ, -3.3% YoY).

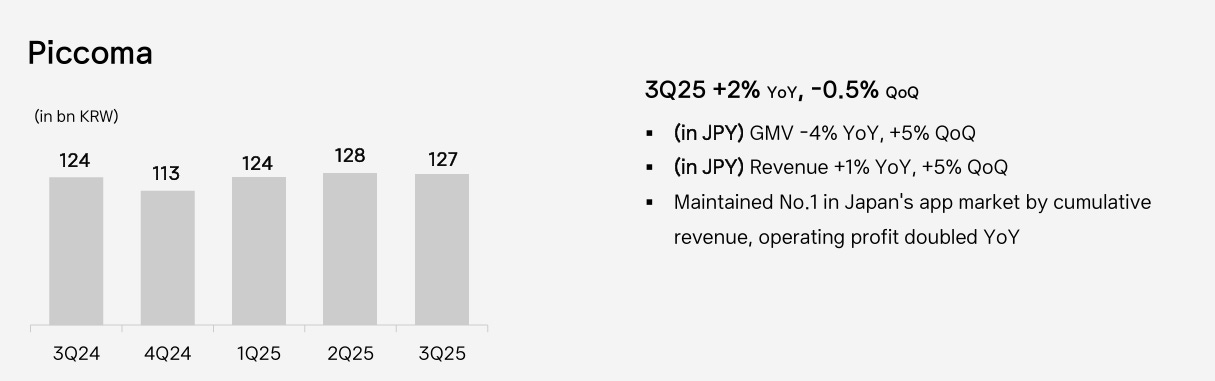

Piccoma specifically saw 127 billion KRW (2% QoQ, -0.5% YoY) which is stable, but concerning due to rival Naver’s meteoric rise in app sales for Line Manga. Piccoma has yet to counter this massive growth or show significant growth of their own. More worryingly, Entertainment saw 84 billion KRW (-11% YoY, -7% QoQ). The continued stagnation of Piccoma’s revenues while Entertainment shrinks calls back to the many rumors that Kakao was considering splitting Kakao Entertainment off from the parent company and readying it for sale.

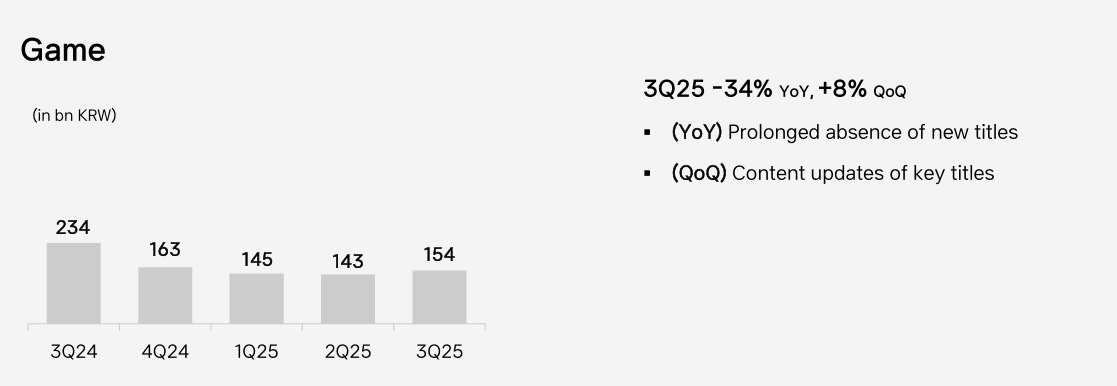

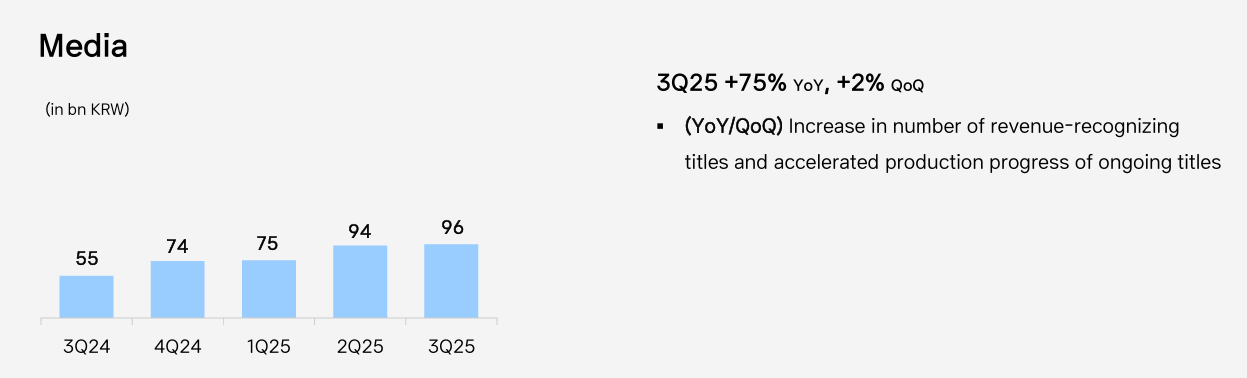

Finally, Game saw 154 billion KRW (8.1% QoQ, -34% YoY) while Media accounted for 95 billion KRW (1.7% QoQ, 75.3% YoY).

Looking Forward

One of Kakao’s latest pushes was the integration of ChatGPT straight into KakaoTalk. Time on app is likely to increase moving forward, but whether this will result in increased revenue is yet to be seen.

But the biggest question by far is the webtoon and webnovel business (mostly because this is Webtoon-ish, where I look at webtoons). As I mentioned earlier, Kakao-Piccoma has yet to develop a strong response to Naver’s movements not just in the Korean market, but internationally.

Over the course of 2025, Naver has released a new TikTok style content tab, refreshed their WEBTOONS homepage, announced a partnership with Disney, and announced the developments of multiple K-dramas, films, and anime adaptations. By comparison, Kakao has been eerily quiet.

Criminal charges against the founder of Kakao were dropped recently, which means he’s free to take back the reins of the company and hopefully smooth the bumps that have appeared since his legal troubles began.

Kakao will be releasing their detailed quarterly report on the 14th. I’ll be taking another look then, but barring some insane news, that update may be localized to LinkedIn so be sure to follow me there.

For more information on Kakao, I suggest checking out their Investor Relations page which has all the information I mentioned here and a bit more.