Peeking at WEBTOONS Through Naver's Q3 Report

Big Green sees the green.

Naver has released their Q3 quarterly statement. This post is going to be long enough without an introduction, so…

A Quick Overview of Naver’s Divisions

Naver reports their revenue in terms of five divisions: Search, Commerce, Fintech, Content, and Enterprise.

Search comprises revenue from the Naver search engine which generates revenue from multiple sources, but mostly ads on their search engine.

Commerce is focuses mostly on the Naver Shopping and Naver Plus Store which are similar to eBay and Amazon for Korean audiences.

Fintech is their payment and platform services devision which includes online/offline payment handling through Naver Pay.

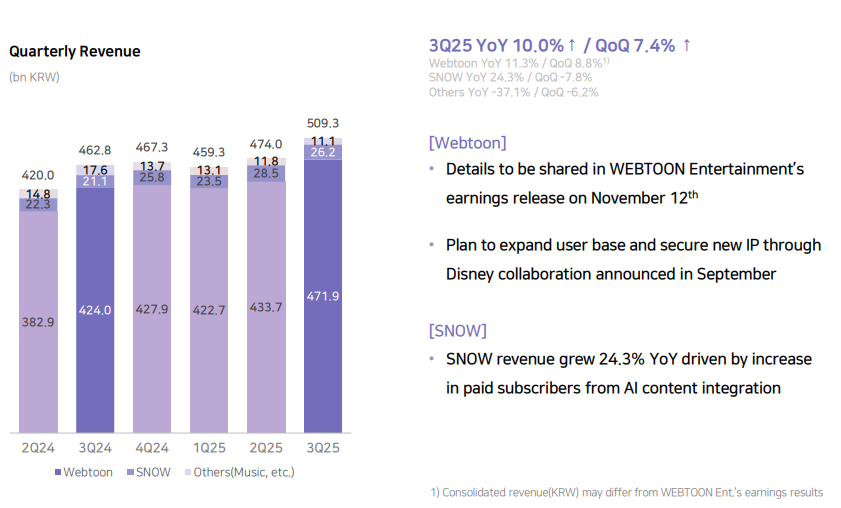

Contents is comprises the Webtoon business as well as the SNOW app which is the Korean equivalent to SNAP in the west.

Finally, the Enterprise division includes Naver LABS, NCP (or Naver Cloud Platform) and Naver Works which is their worplace management system.

A Record-Breaking Quarter

Naver reported over 3 trillion KRW in revenue which marks the first time in the company’s history that they’ve crossed that threshold. The largest driver of growth and revenue for the company has always been the search platform. Commerce saw the largest growth seeing 35.9% YoY growth.

Naver’s shopping options are heavily tied to the search platform, but the two divisions also benefitted from the company’s advancements in AI which boosted ad efficiency during the pre-Chuseok (Korean Thanksgiving) in September.

It’s important to note that Naver is, on the surface and at their core, a tech-company. While they may be known internationally for their massively popular WEBTOON platform, the driver of growth has always been rooted in tech.

What about WEBTOON?

The Contents division of Naver is an indicator of what’s to come for Webtoon Entertainment’s own Q3 report when it releases on the 12th.

Right off the bat, the webtoon business has seen an 8.8% increase QoQ and an 11.3% increase YoY. Other sectors of their content division weren’t as successful with SNOW falling QoQ but showing growth YoY.

The increase in webtoon revenue is substantial and likely driven by the Japanese market. We’ll have to see what the growth looks like internationally as well as whether the company has been able to stifle losses in the Korean market.

One of the biggest announcements in their Q2 report was the collaboration with Disney. It’s unlikely that the partnership will have borne fruit this early, but with multiple irons in the fire (including the Netflix meetings earlier this year), it’s possible that Naver has more announcements to come.

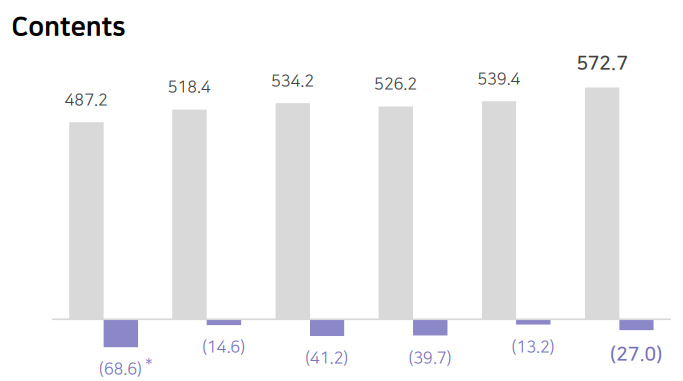

While the Content side is seeing increases in revenue, they’re still operating at an overall loss. This isn’t unexpected as WEBTOON hasn’t made any significant strides in increase paid-user conversion or through implementation of new tech.

The implementation of AI on their search and commerce platforms was an easy hit, but Naver and Kakao haven’t seen the same successes in their home markets with content recommendations. Thus far, the AI boom hasn’t been a boon to publishers who aren’t actively using generative AI to create content.

I’d recommend checking out their quarterly statement which is available here. The company as a whole is benefitting from a resurgence of domestic investors in the Korean stock market after the newly elected president signalled that rejuvenating the KOSPI would be one of his goals in this term.

I most certainly have questions about the state of WEBTOONS, but we’ll have to wait until next week to get answers. But, at the very least, Naver’s quarterly report gives us a sign that there’s still signs of growth in the industry as a whole.