Manhwa, Webtoon Industry Numbers for the First Half of 2025

And the hits keep coming.

KOMACON, the Korea Manhwa Contents Agency, released their numbers on the manhwa and webtoon industry for the first half of 2025 (KOCCA).

These stats are based on data provided to the government (and government funded agencies like KOMACON) from webtoon and manhwa publishers and platforms. As KOMACON is a Korean agency, these numbers and stats reflect the Korean market, publishers and content producers.

I’m not ashamed to say that this report is prepared by folks who have been in the industry longer than I have and absolutely know more than I do. So while I’ll be clarifying certain sections for context, most this post will be summarizing and explaining key sections of the report I found interesting.

The Industry at a Glance

Let’s start with the big numbers.

KOMACON registered 8,123 new webtoons, 2,256 new print manhwa, and 4,357 new digital manhwa in the first half of 2025. The webtoon number can be broken down further into titles launched in 2025 (removing relaunches) as well as individual titles (removing duplicate listings for non-exclusive titles).

8,123 “new” registered webtoons

5,543 “new” launches

2,322 “new” titles

On the manhwa side, there are 6,613 new manhwas launched with 2,256 titles in print and 4,357 titles in digital. Only 73 titles launched both a digital and print published version in the first half of 2025.

Compared to 2024, the number of “new” registered webtoons fell from 9,889 which makes sense considering the slowdown of the industry including the closure of key webtoon platforms in the Korean market.

This year’s print manhwa numbers rose by 2.2% from 2,209 last year. In the last half of 2025, the industry saw a slight resurgence of print webtoons and webnovels, a trend that may continue into this year. Unsurprisingly, digital manhwa fell by 4.5% as the market shifts to webtoons. There are fewer and fewer platforms that specialize in digital manhwa in Korea and fewer studios as well.

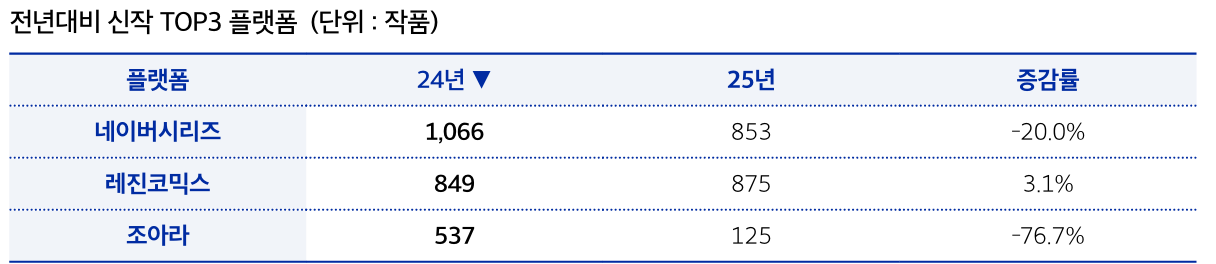

Newer is Always… Newer

When looking at the top webtoon publishers in Korea, Naver would obviously rank high. But, at least for H1, Lezhin Comics takes the top slot having 875 new webtoons launch on their service. Naver Series is a close second with 853 titles while Joara comes in at 125. Naver Series actually saw a drop in their numbers this year while Lezhin increased their H1 new launches by 3.1%

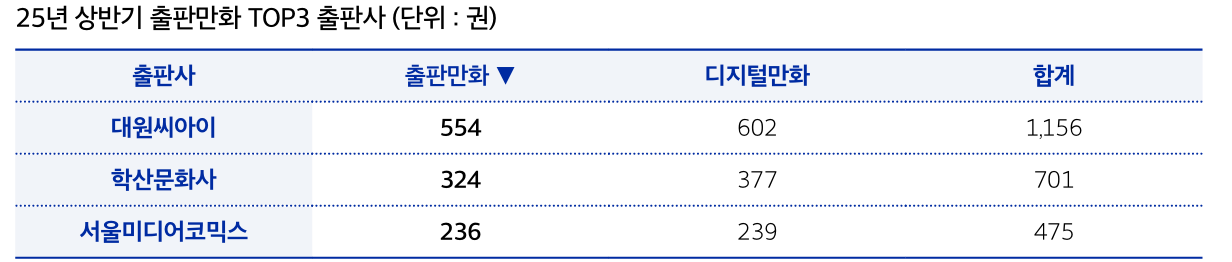

In the print market, there were 232 print publishers active in the Korean market. Daewon CI, one of the oldest and longest running print publishers in Korea, takes the top slot with 554 print manhwa and 602 digital manhwas published. Next is Haksan at 324 print and 377 digital followed by Seoul Media Comics which had 236 print and 239 digital.

Surprisingly, the digital manhwa side is quite different. Korea Contents Network released 1,119 digital titles followed by Daewon with their 602, then Mister Blue with 418 digital manhwa.

Of the company listed here, Mister Blue and Seoul Media Comics operate their own webtoon/manhwa platforms in addition to producing webtoons, manhwa, and digital manhwa.

Evaluation of the Korean Market

Included in KOMACON’s report were a set of overall evaluations of the Korean market. There are three chief points that the report focuses on:

2025 continues the pattern of webtoon industry contraction that was seen in 2024.

Even though the webtoon industry as a whole is receding, the adult market seems to be growing.

The manhwa market’s growth shows promise, even if it’s just a glimmer.

The market contraction that started in 2024 has essentially continued into 2025. But it’d be a mistake not to take international markets into consideration when looking at the Korean market.

I’d argue that the reduction in numbers has just as much to do with webtoon publishers/platforms being risk-averse due to lack of success in foreign markets. Without revenue from abraod to cover domestic losses, platforms and publishers are relying on “what works”. That often means moving away from quirky or unique independent titles (of which there are many) and leaning into mainstream studio projects (of which there are fewer).

In the case of the adult market, the report specific references the growth of Lezhin Comics who published the most new webtoons in the first half of 2025. It’s worth looking at Toptoon which only had 27 new launches in 2025 H1, a reduction of 51.8%. While Toomics launched 62 titles, down 8.8% from last year.

It is, however, true that the overall trend of webtoon content production is leaning much more towards adult content with Naver’s recently releases being 48.9% adult. Whether there is a separate adult market to capitalize on or whether it is market cannibalization remains to be seen.

And in the manhwa market, it is undeniable that there is a glimmer of hope. In a market where there are still (quite possibly) too many webtoons for audiences to consume, the print market is not standing idling by or simply maintaining their market.