Naver 2025 Q2 Earnings Report

More questions than answers.

Naver Corp’s 2025 Q2 Earnings overview is up (link). Naver Corp is the parent company of WEBTOON Entertainment Inc based out of South Korea. And, if you don’t know, Naver Corp is essentially the Korean equivalent to Google operating a search platform (Naver) as well as multiple other business.

WEBTOON’s own earnings report will be out on August 12th, but until then we can pick apart the numbers in Naver’s report and see what might be coming down the pipe next week.

Color By Numbers

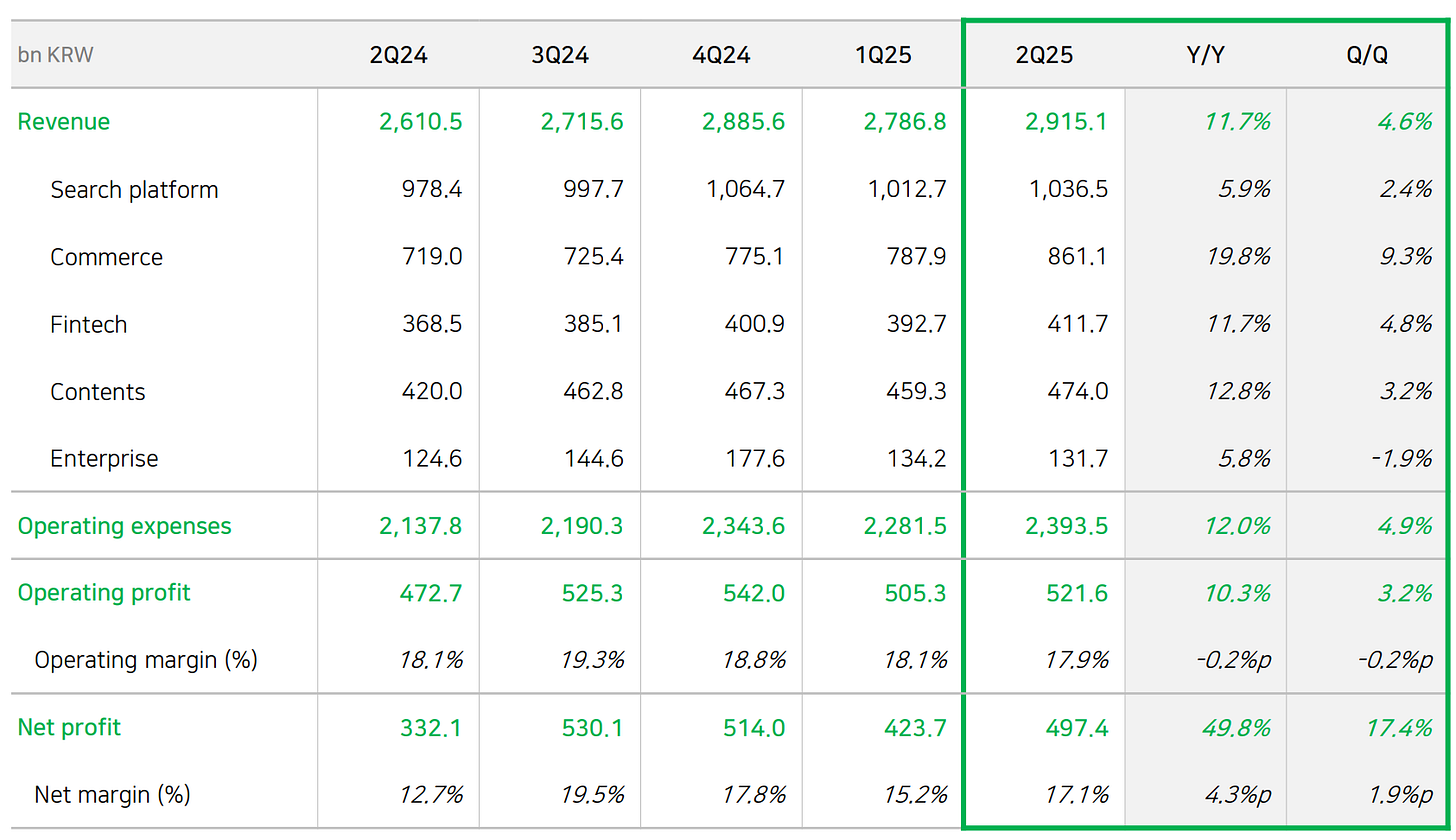

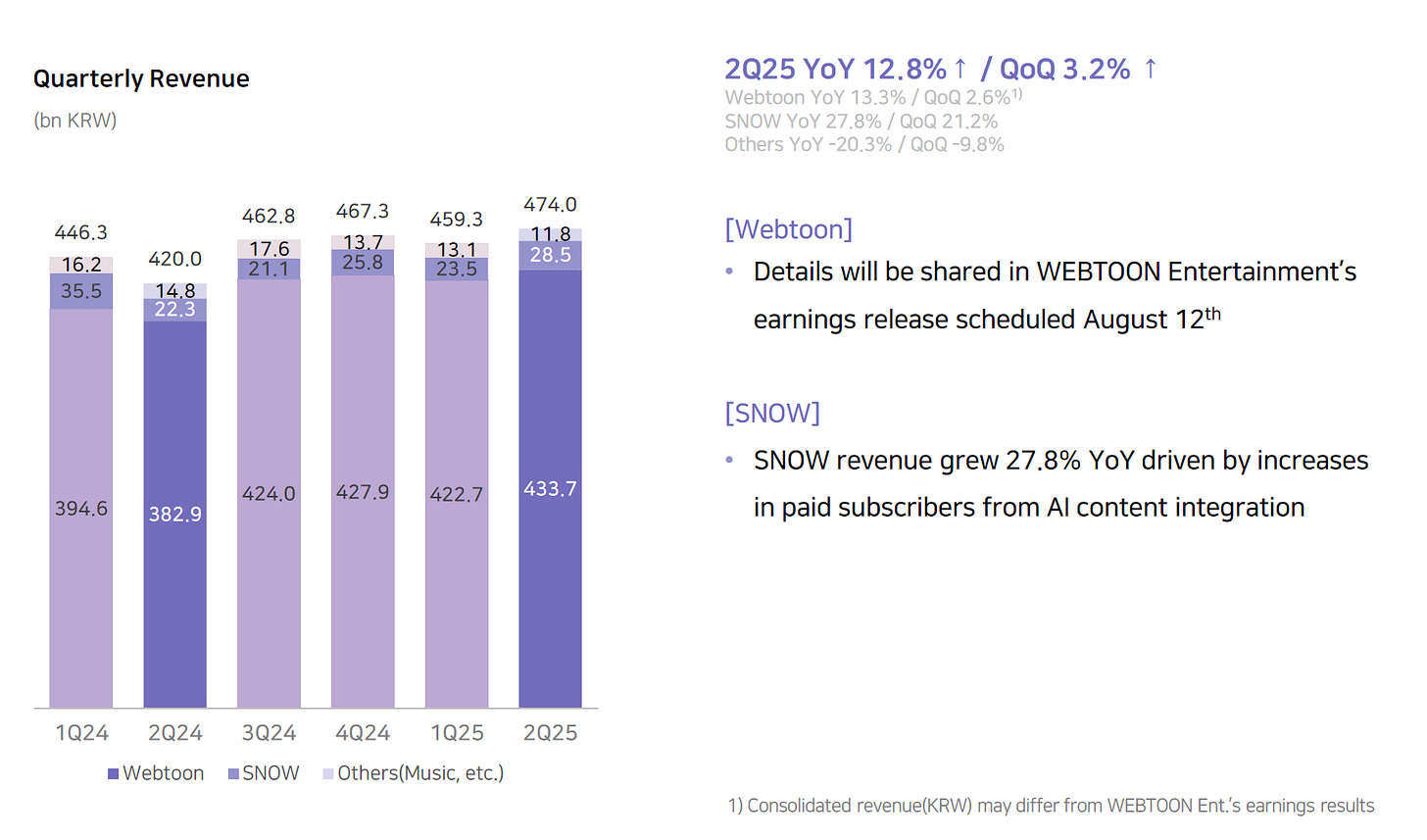

First up, the company as a whole is performing well. Naver Corp is reporting revenue of 2.9151 trillion KRW for 2025 Q2 which represents an 11.7% YoY increase. This actually beats Chosun Biz’s prediction of 2.9049 trillion KRW that they made a week ago.

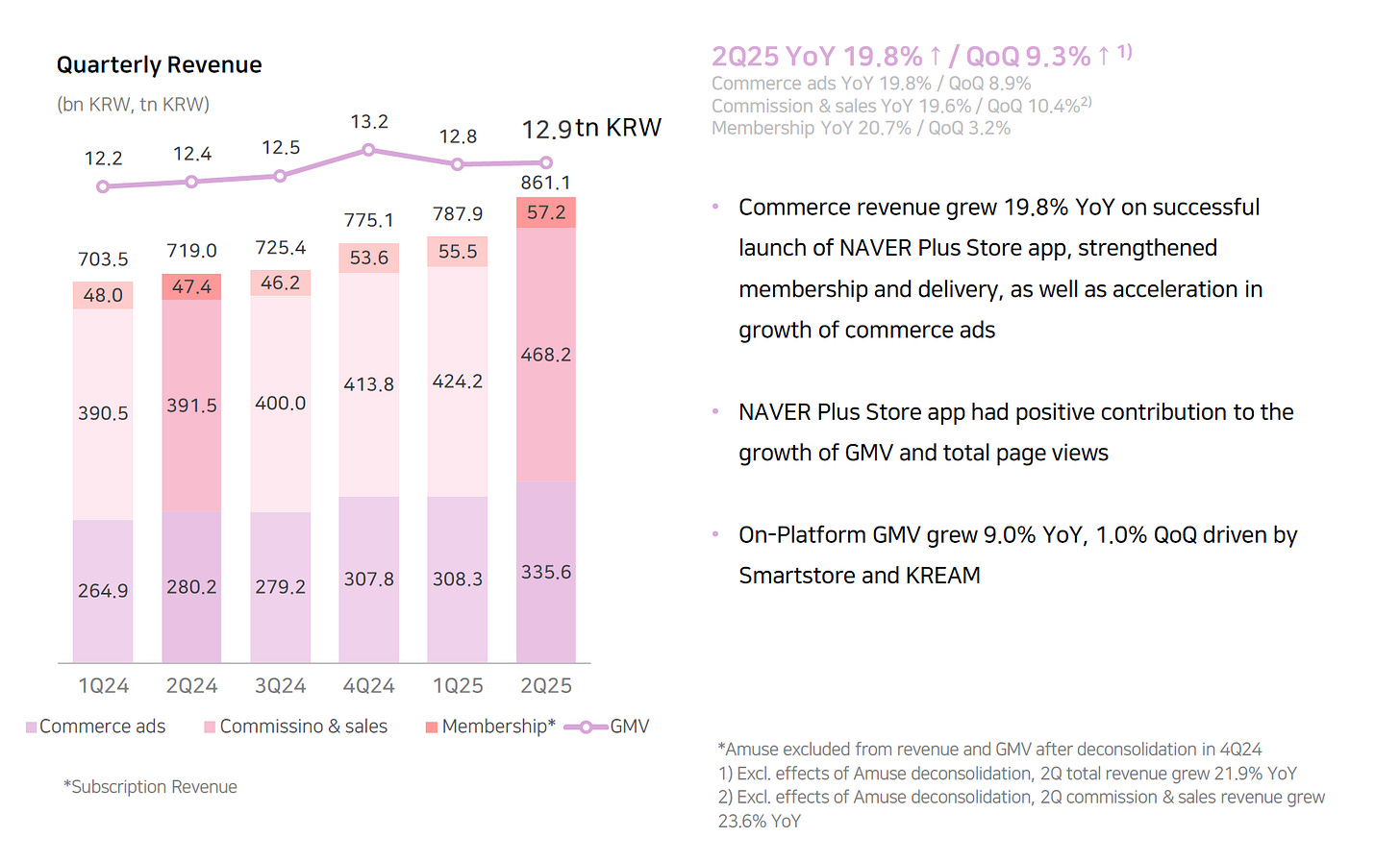

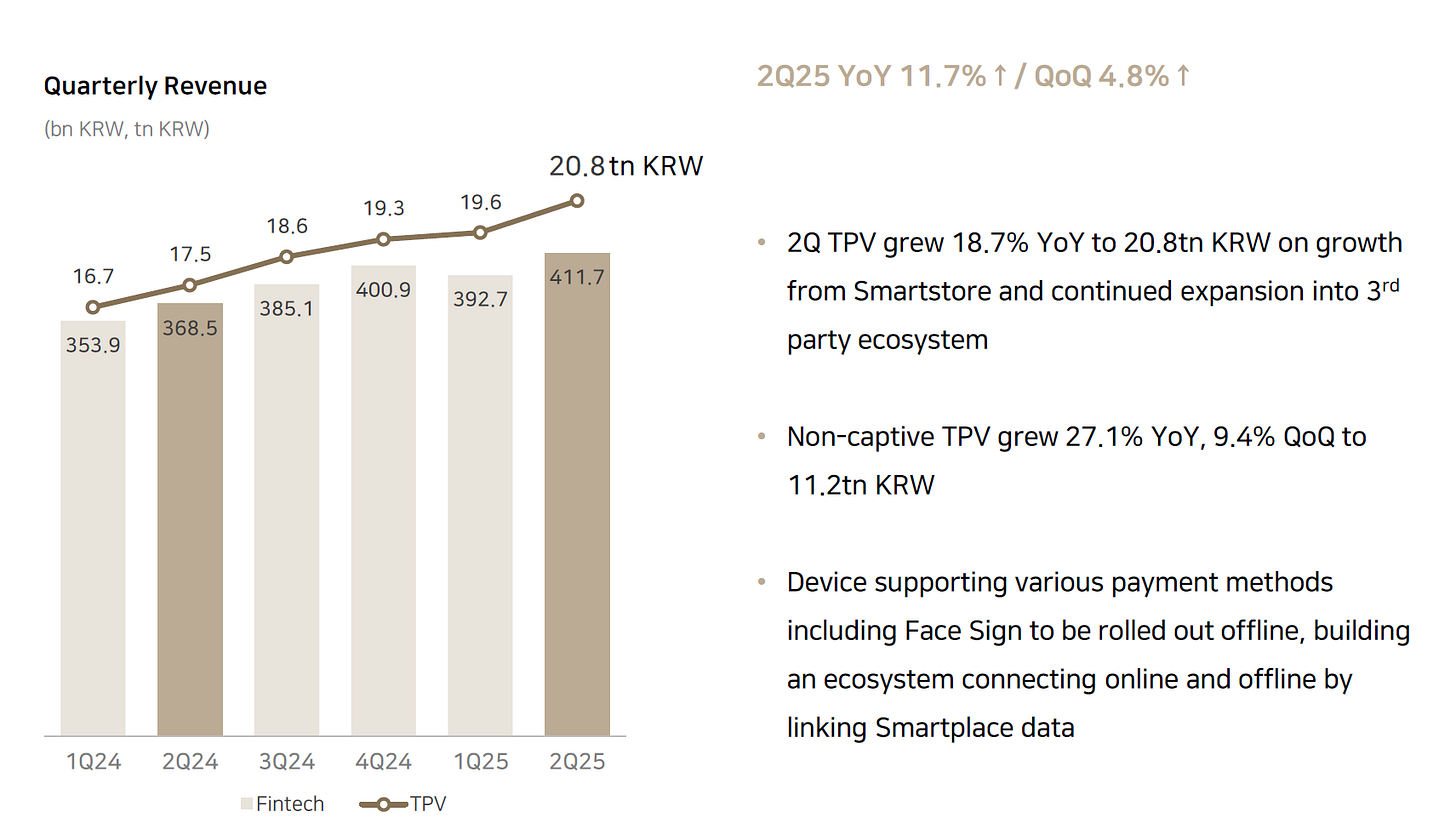

The biggest increases are in Commerce (19.8%), Fintech (18.7%) and the Contents (12.8%) sectors. This is in line with analysts who predicted the addition of Naver Plus Store shopping to the commerce catalogue would log considerable growth for the company.

Profits for the company are down, but we can attribute that to the increased operating costs related to their new Commerce platform as well as the extra resources of developing and maintaining the tech that powers it.

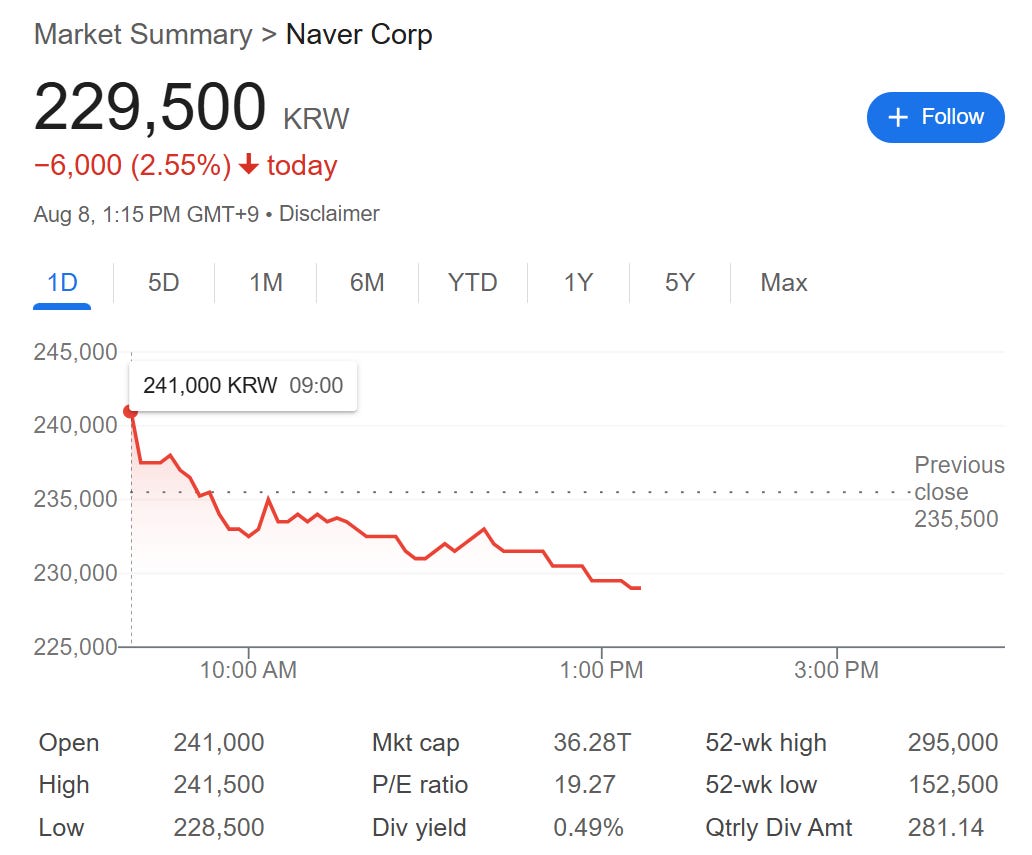

So, everything is going just as analysts expected…. and by mid-day, the stock has dropped about 2.5% in the KOSPI.

The WEBTOON Elephant in the Room

WEBTOON will be announcing their own, more detailed report, on August 12th. Until then, we have the overview numbers in this report so…

Webtoon’s revenue was 433.7 billion KRW in 2025 Q2. That’s roughly a 13% increase over 2024’s 382.9 billion KRW. It’s important to remember that WEBTOON is essentially the international face of the company as it’s listed on NASDAQ. So, it may be August 12th’s release that really gives the Naver Corp stock in Korea a boost (or not).

Q1 saw a recession from Q4 due to a variety of factors, not the least of which was a drop in Paid Content. While the reasons can’t be fully attributed to a scandal that plagued Big Green from late-Q3, the drop of female users resulting from the public outcry certainly didn’t help.

The Story to Come

The biggest factor that might affect the Q2 earnings report is likely the removal of the Daily Pass system. Previously, this allowed users to unlock one free episode each day for completed titles. Other platforms like Lezhin, Tapas, and Tappytoon utilize a similar feature usually known as “WUF” or “Wait-Until-Free”.

Other than that, the UI/UX change happened in late-June and the “Windbreaker” scandal hit in July. In anything, Q2 represented a chance to distance themselves from other platforms which closed during the same time.

Here are the main questions that I’ll be looking for answers to come August 12th.

Is Paid Content still on the decline?

Q1’s quarterly report had a disappointing drop in Paid Content which was helped by advertising and IP adaptations. And while WEBTOON can tout their advertising and IP adaptations, the strength of their IPs is based on the “purchased” power of webtoon episodes.

Daily Pass being removed in favor of ad-actions increases the potential revenue for the platform while updating UI/UX works if we’re heading away from active operations (i.e. weekly promotions, banner designs, etc) and moving towards reduced costs and passive operations. But, due to there being less free content on the platform, fighting piracy is a necessary step in order to transition users to Paid Content.

If we see a continued drop in Paid Content, especially outside of Korea and Japan, that would be a huge sign that the market isn’t as mature as publishers might hope and the UI/UX design change WEBTOON implemented may result in further losses for Q3.

Original Webtoons in the West

The biggest hurdle holding the webtoon industry back is their inability to produce the same high-quality content from Korea outside of Korea in significant numbers. Until a webtoon focused platform-studio ecosystem develops outside of Asia, publishers need to find an alternative and that may be more in-house developed IPs like “Accidental Assassin”.

Currently, there are only a handful of studios outside of Korea and Japan able to handle this level of production and the production volume doesn’t even come close. Kidari Studio is has run their own test with “The Phantom of the Opera” on Lezhin, but that was a one-off. Meanwhile, Tappytoon and Tapas have pivoted away from overseas content while European markets are still hopeful.

The problem remains that there is a lack of quality content in the overseas market and WEBTOON isn’t going to invest in jumpstarting this ecosystem, who will?

Is there room for growth in Asia?

This is a general one, but it’s an important one. WEBTOON has posted growth in Japan and seen shrinkage in Korea.

Big Green’s performance on their homecourt echoes in international markets. The majority of content that is successful in foreign markets is Korean in origin. If that domino falls… speaking as someone sitting underneath that domino, I hope it doesn’t fall.

The only thing that would offset a hit in Korea would be massive growth in Japan. That could be sales of Original Japanese content or showing that Japan will support the production and export of Korean webtoons. As the two largest markets for webtoons, the K-webtoon industry has to have these markets on lock to make the rest of the world viable.

I’m not interested in “Cuts”

Yes, this isn’t a question and it’s much more of a statement.

Naver’s oft-talked-about short-form video content platform is slated for a September launch, so it might not make the conversation and it shouldn’t. Short-form video’s popularity is old news internationally and I think jumping on the bandwagon this late in the game isn’t going to garner much interest.

Short-form content isn’t the future of paid content, at least not in the short term. It’s the king of “screen-time”, but monetizing it is insanely difficult. Just ask TikTok.

Unless “Cuts” offers a gamechanging tool in gaining WEBTOON more screen-time, it’s not likely to garner much interest.