WEBTOON Stumbles in Q3

I don't think this needs a subtitle.

The total revenue of webtoon for Q3 is 378 million USD, an 8.6% increase YoY compared to Q3 of 2024.

The bulk of the revenue comes from Paid Content which accounts for 286.81 million USD (0.6% YoY), 39.37 million USD from Advertising Revenue (-9.3% YoY), and 51.86 million USD from IP Adaptations (168.7% YoY).

Their Marketing budget has increased from 32.72 million USD in 2024 to 35.17 million USD this quarter. So far, they’ve spent 97.78 million USD in 2025, a 29% increase frrom Q1 - Q3 in 2024.

Based on these figures alone, WEBTOON is showing decent growth even if their marketing budget has increased with a decrease in overall ROI. But considering Big Green’s return to Anime Expo this year, it stands to reason that the marketing budget would’ve required a boost to meet fan expectations for in-person events.

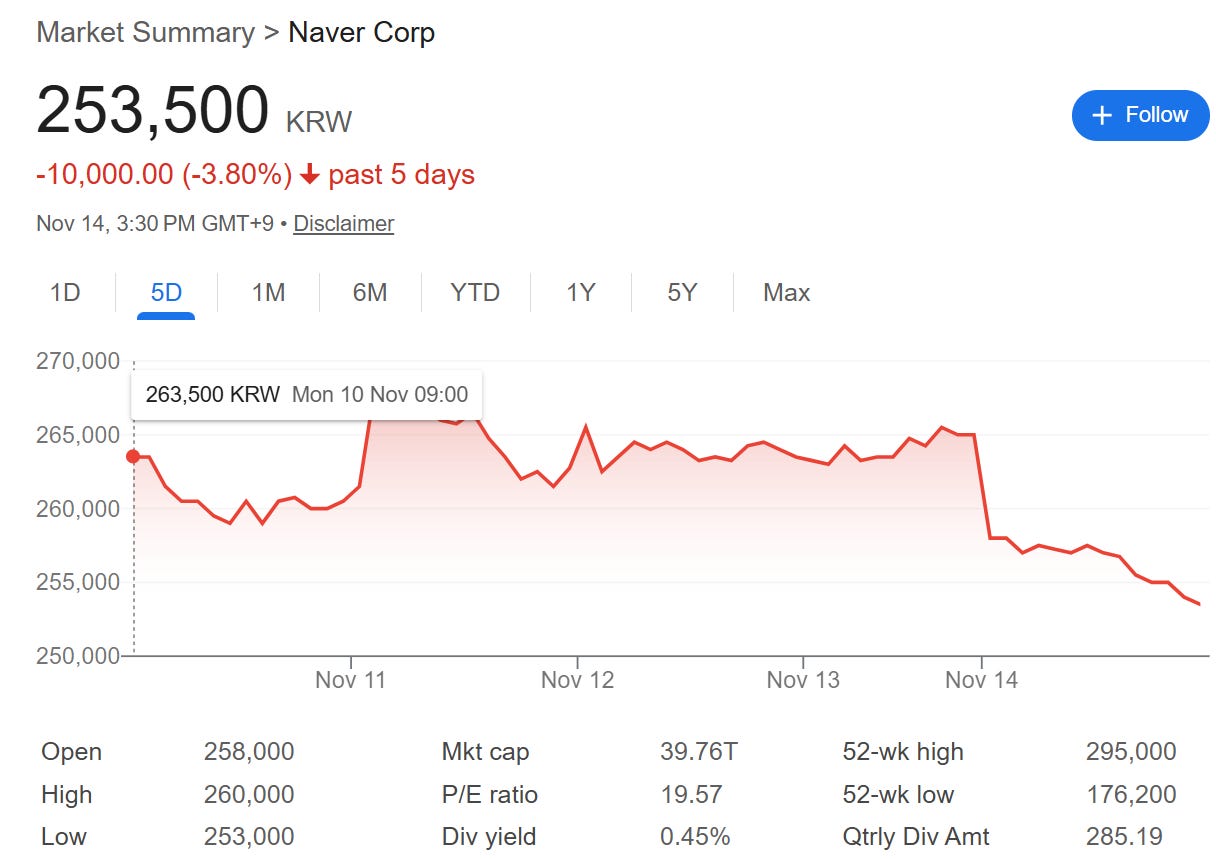

As I’m writing this a few days out from release, the market response has not been kind. The recovery to WBTN that we saw after the Q2 report has been mostly wiped out with a return to the 12 USD range.

Naver’s stock in Korea has also taken a hit showing just how reliant the company’s fortunes may be on their subsidiary’s standing in the west.

That being said, I’m not a market economist and therefore have no interest in talking about Big Green’s stock. There are a lot more interesting numbers to unpack, but first let’s start with the news of the day.

Another Day, Another Partnership

The big news of the day is the Warner Bros. Animation partnership which has WEBTOON set to co-produce 10 WEBTOON titles for global distribution.

“Webtoon has become one of the most exciting sources of original storytelling in entertainment today,” said Yongsoo Kim, Chief Strategy Officer and Head of Global Webtoon. “Our Creators are building franchises that Gen Z audiences love, and working with Warner Bros. Animation gives us an incredible opportunity to take those stories further alongside one of the most respected names in animation.”

Quote from WEBTOON’s CSO on Deadline.

Only a handful of the 10 titles have been announced, but they include The Stellar Swordmaster, Harcore Leveling Warrior, Down to Earth and Elf & Warrior. This would represent a considerable step outside the current slate of Looney Tunes and DC animated series/films that WB is currently heading up.

While this announcement hasn’t generated the same buzz as the Disney Deal back in August, it does continue WEBTOON’s longstanding trend of working with established western companies in order to achieve landmarks in content production.

The Korea Problem

Let’s move on to the revenue breakdown by locale.

The Japanese market continues to show growth with 164 million USD for Q3 representing a 2.6% growth YoY. And while the rest of the international market isn’t as strong, the 34.648 million USD is a 2.2% increase.

Both sectors have shown slow, but consistent growth since WEBTOON went public last year. Japan increased their revenue since 2023 along with their ARPPU (22.05 USD in 2023, 23.06 USD in 2024, and 23.6 USD in 2025), it seems relatively obvious to all involved that the Japanese market is the main market showing growth for Big Green.

The Rest of the World is also showing growth with the ARPPU showing steady growth (5.96 USD in 2023, 6.69 USD in 2024, to 6.8 USD in 2025) along with increased revenue. It’s almost impossible that the entirety of the international market is growing, more than likely there are two or three outliers while the others are less than stable.

But Korea’s revenue dropped for yet another quarter to 88.01 million USD representing a 3.7% decline YoY. That’s a 7.7% decline thus far for 2025 compared to 2024 with only three months left in the year.

Zoom out a bit further and this is a marked decline from 96.7 million USD for Q3 in 2023. The ARPPU then was 7.6 USD, but the increasing ARPPU is likely due to the drop out of lower-tier purchasing users which results in a higher ARPPU but a lower overall revenue.

In fact, the company has shown YoY declines in revenue since Q2 of 2023 showing consistent losses in the Korean market. The problem is… this isn’t a WEBTOON problem. The Korean market is showing signs of slowdown which will undeniably reflect across the industry as a whole

.

Implementing short-form videos like Cuts was a valiant effort, but obviously it hasn’t worked as well in the short-term to keep users on the platform. And while I’ve written more than a few words on the subject of short-form content, there’s a bigger problem with WEBTOON’s 2025 strategy.

Daily Pass.

The “Daily Pass” Cancellation

The biggest change made to WEBTOON’ internal ecosystem wasn’t the UI shift or even the Disney Deal back in Q2. It was the widescale removal of Daily Pass back in May of 2025.